massachusetts estate tax rates table

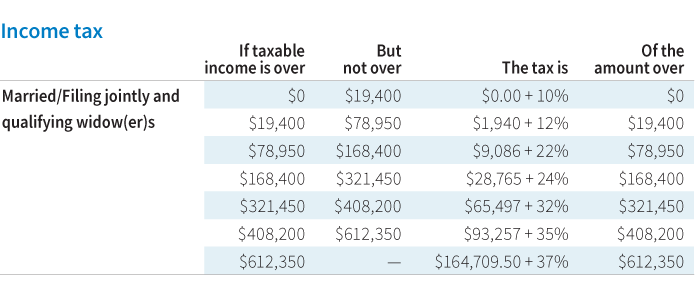

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Up to 25 cash back In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Settlement Tax Rate Table.

. Massachusetts Estate Tax Rate. A state sales tax. A local option for cities or towns.

The estate tax rate for Massachusetts is graduated. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. Compared to other states.

2022 Massachusetts Property Tax Rates. Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value every year in property taxes. The towns in Hampden County MA with the highest 2022 property tax rates are Longmeadow 2464 Wilbraham 2049 and East Longmeadow 2029.

Detailed Massachusetts state income tax rates and brackets are available on this page. The average residential property tax rate for Hampden County is 1769. Check Hot Trending Viral Search Suggestions for Mass Estate Tax Rate Table.

The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464. A guide to estate taxes Mass Department of Revenue.

The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. The Massachusetts estate tax exemption is 1 million. Ad Compare Your 2022 Tax Bracket vs.

50 personal income tax rate for tax year 2021. This means that if your estate is worth more than 1 million when you die money will be owed to the state before its disbursed to your heirs. Take a look at the Massachusetts estate tax rates table below.

To figure out how much your estate will need to pay in estate. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms. The tax rate ranges from 116 to 12 for 2022.

Town Residential Tax Mill Rate Commercial Tax Mill Rate. The average residential property tax rate for Hampshire County is 1749. To find out the exact state estate tax owed in 2021 see the Massachusetts Department of Revenues Computation of Maximum Federal Credit for State Death Taxes.

This adds up to 1138 for every 1000 in home value. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Discover Helpful Information and Resources on Taxes From AARP.

Your 2021 Tax Bracket to See Whats Been Adjusted. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states. The towns in Hampshire County MA with the highest 2022 property tax rates are Amherst 2127 Pelham 2056 and Westhampton 2049.

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. Click table headers to sort. To figure out how much your estate will need to pay in estate taxes first find your taxable estate bracket in the chart below.

Taxable estate Marginal rate 0 40000. And yes its complicated. Sales rate is in the top-20 lowest in the US.

Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600. 2022 Property Tax Rates for Massachusetts Towns. A state excise tax.

Form M-706 Massachusetts Estate Tax Return must be filed by the executor of every estate when the Massachusetts gross estate of a resident decedent or the Massachusetts gross estate of a non-resident computed as if the decedent had been a resident exceeds that applicable exemption. The table below lists all of the rates. The filing threshold for 2022 is 12060000.

Integrate Vertex seamlessly to the systems you already use. The three Hampshire County towns with the lowest property taxes are Hadley 1218 Hatfield 1367 and Cummington 1445. Updated May 28 2022.

Using the table this tax is calculated as follows. Certain capital gains are taxed at 12. Of all the states Connecticut has the highest exemption amount of 91 million.

5000000 - 60000 4940000. In the second column youll see the base taxes owed on wealth that falls below your bracket. Starting in 2023 it.

What that means is for the same house it is more expensive to live in Longmeadow than in Chilmark because the property taxes are higher in Longmeadow. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

The estate rate tax depends on the size of the estate. Of that 167 billion or 216 of the total revenue collected is from property taxes. If you were to translate the amount owed into a tax rate.

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. Massachusetts Estate Tax Exemption. A properly crafted estate plan may.

Everyone whose Massachusetts gross income is 8000 or more must file a. The three Hampden County towns with the lowest property taxes are Tolland 900 Montgomery 1395 and Blandford 1479. Unrivalled Results for Mass Estate Tax Rate Table - Are You Ready.

The rate ranges from 8 to 16. The table below lists all of the rates. More details on estate taxes in Massachusetts are described further in the article.

The estate tax rate is based on the value of the decedents entire taxable estate.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Alcohol Excise Tax Rates Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Massachusetts Estate Tax Everything You Need To Know Smartasset

There S A Growing Interest In Wealth Taxes On The Super Rich

Massachusetts Estate And Gift Taxes Explained Wealth Management

How Do State And Local Corporate Income Taxes Work Tax Policy Center

A Guide To Estate Taxes Mass Gov

The Kiddie Tax Changes Again Putnam Investments

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

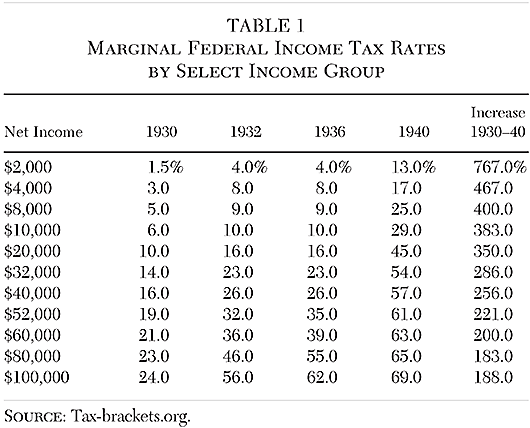

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada